To grow sustainably, Anchorage must adopt a land value tax

A change in the way properties are taxed could incentivize development and limit sprawl

You may have asked yourself: What’s going on with that big vacant lot downtown or maybe the boarded-up house in your neighborhood? It just sits there empty, sometimes for decades. Why doesn’t someone build something there?

The answer is typically a very simple one: Speculation.

Real estate investment comes in many forms, from the flippers fixing up an old house in a popular neighborhood to developers constructing a new mixed-use building downtown, it can be very lucrative and a sign of a healthy community. There is, however, another form of real estate investment that is beneficial only to the investors and can actually be harmful to communities and this is real estate speculation. In this scenario, an investor will buy a vacant lot or distressed building for a low price and simply wait until prices go up and sell for a profit. When prices go up, it’s usually a direct result of investments made by the community from infrastructure improvements or simply the elbow grease of the neighbors fixing up their homes – The speculator profits from the efforts of others, eventually.

Nineteenth-century economist and writer Henry George famously argued that the value of land is created by the community through investment in public works and therefore the economic rent of land is the most logical source of public revenue, and it is, sort of.

In most US cities, (Anchorage included) property taxes are assessed on a valuation formula that combines the assessed value of the land and the value of the improvements (the house or building). However, this is not an equal formula and most of the taxable value of a property lies in the value of the improvements (the building). The more valuable the improvements are the higher the taxes will be, sounds counterproductive, right?

A land value tax (LVT) as the name implies simply shifts most of the taxable value of a property to the land itself rather than the value of the buildings on it.

Proponents of LVT argue that the current tax structures disincentivize investment and reward neglect – Property owners are less likely to want to improve their properties if their taxes will go up as a result. This also encourages sprawl by pushing development further away from established neighborhoods and the urban center.

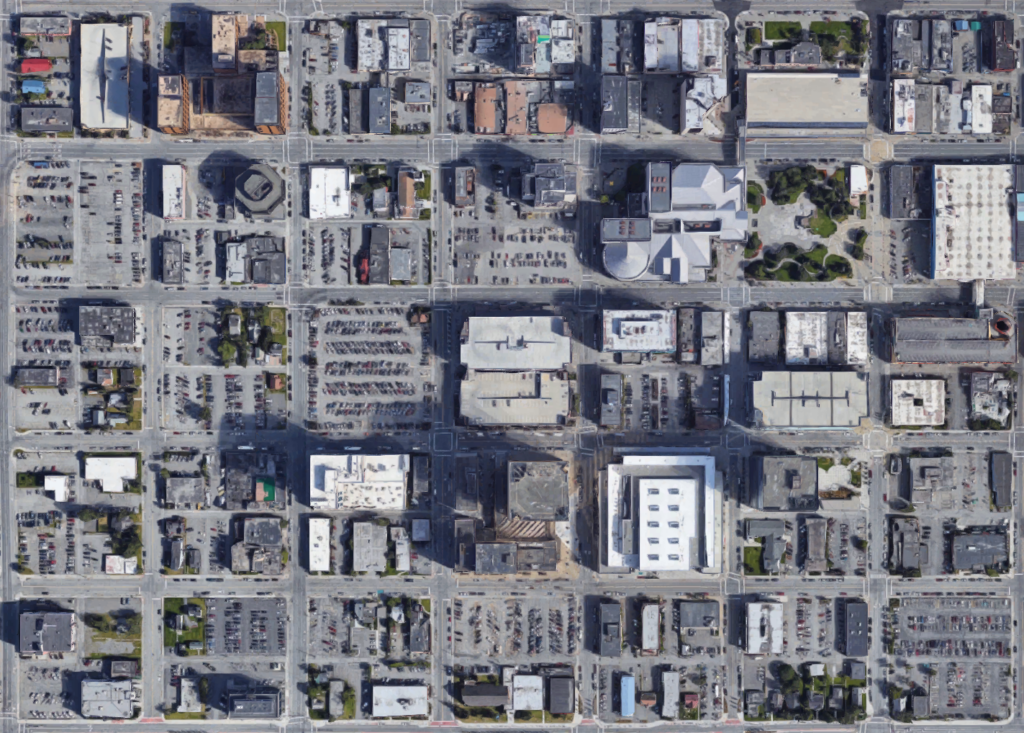

In downtown Anchorage, we have a perfect example of the effect of real estate speculation: Surface parking lots. The improvement value of asphalt, pay-boxes, and lighting is very low compared to buildings, giving the owners of parking lots an effective means to park their investment. The parking fees collected at the lot are generally enough to pay the taxes and utility costs enabling the speculator to hold prime downtown real estate until the value is high enough to consider selling. This is an example of how current tax laws reward inaction and keep speculation viable.

How property taxes are levied now

The total value of a property (land + improvements) is multiplied against what is called the “mill rate” of the district. Mill rates vary across different districts and are levied based on available services and improvements in the area (schools, fire, parks, etc.)

The formula below from the Municipality of Anchorage shows how a property value of $200,00 is taxed against a typical mill rate to yield the annual tax liability of the property.

| Taxable Value x Mill Rate | 200 ($200,000 divided by $1,000) x16.25 Mills | |

| Tax Owing | $3,250.00 | |

| OR $200,000 x.01625 | ||

| = | $3,250.00 |

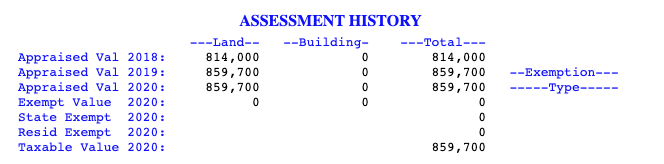

The Assessment History below shows an actual tax record for a property near downtown Anchorage. This property is a 171,000 SF vacant lot with an assessed tax value of $859,700. As you can see, since there are no improvements, the taxable value is actually quite low. Using the formula above we find that the annual taxes for this property are only $13K – A great investment for the land speculator.

If Anchorage adopted a land value tax, the owner of this property would be faced with a much larger annual tax bill which, theoretically, would either encourage them to build something on the land to make it profitable or sell it to someone who will.

How would the land value tax affect my property taxes?

The current tax structure actually inflates property taxes because the land held by speculators is insufficiently taxed despite having the same access to infrastructure, services, and community improvements. Fire protection services, water/sewer, and street maintenance services must be rendered to all properties regardless of whether they have a building on them or not.

Speculation artificially restricts the amount of available land in older well-established neighborhoods and urban centers, creating more sprawl which creates the need for more infrastructure and services – driving taxes up.

Some critics will try to suggest that these types of changes will price people out of their homes and this is simply untrue. The LVT levels the field by shifting the taxable value from the building to the land. The only people that would end up paying more in taxes are those holding vacant lots.

The time is now

Anchorage is at a critical juncture, in a time when fiscal uncertainty is threatening our state, Anchorage is tasked with being the beacon of prosperity and economic success – To achieve this, or even simply to survive, we must build to attract more people to our city and convince our young people to stay. Housing prices are expensive and suitable homes are scarce, you’ve no doubt heard people say that Anchorage has nearly run out of buildable land – in reality, the amount of buildable land that is sitting vacant due to speculation is staggering. The land value tax is not a quick fix and is not a cure-all to our development woes but it along with up-zoning will make the prospect of building new things more realistic by making land available.

Anchorage is Alaska’s urban center, not a parking lot. Contact your assembly representative and tell them you support a land value tax.

Thanks for this great article! I grew up in Anchorage, so I was especially interested in it. I am just learning about market urbanism and all that it encompasses: fiscal sustainability, affordable housing, zoning, etc. So I am just learning about land value tax. I think it’s a great idea! I hope that your website helps the people of Anchorage to support sound policies for growth.